Why the Utica Shale is Under-Appreciated

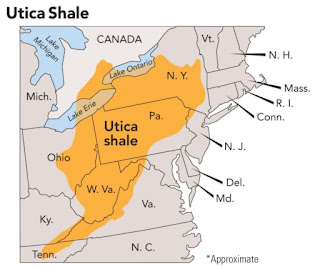

In the United States, there are seven main Shales (Bakken, Niobrara, Permian, Eagle Ford, Haynesville, Marcellus, and Utica). The Permian and Eagle Ford Shale, located in Texas, are the highest producing Shales in the United States. Among all of them, the Utica Shale seems to be the one with less popularity despite bringing many investments and job opportunities for Ohio. In today's post, we will discuss why the Utica Shale is under-appreciated and how it has benefited Ohio. Marcellus Shale Perhaps one reason why the Utica Shale is under-appreciated is that it's located right next to the Marcellus Shale. The latest report estimates that the Marcellus Shale yields about 14.4 billion cubic feet of natural gas per day. In 2015, it was the source for over 36% of the shale gas produced in the United States and 18% of the total dry gas production of the United States. Of course, the Utica Shale is small in comparison to the Marcellus Shale. Despite that, the Utica Shale still holds s...