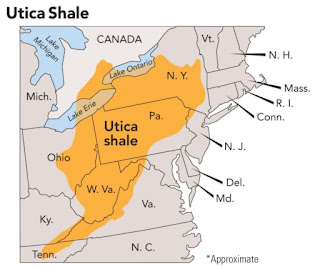

Why the Utica Shale is Under-Appreciated

Marcellus Shale

Perhaps one reason why the Utica Shale is under-appreciated is that it's located right next to the Marcellus Shale. The latest report estimates that the Marcellus Shale yields about 14.4 billion cubic feet of natural gas per day. In 2015, it was the source for over 36% of the shale gas produced in the United States and 18% of the total dry gas production of the United States.

Of course, the Utica Shale is small in comparison to the Marcellus Shale. Despite that, the Utica Shale still holds strong as a resource producer, and in more recent years, it has gained more production value. Let's take a look now at how much the Utica Shale has benefited the fracking production.

Utica Shale

Ohio has been a significant player in the oil business long before many significant shales were discovered, with the first refineries opening in 1859. Between 1895 and 1903, Ohio was the leading crude oil producer until people found oil in Texas and Oklahoma. In the past decade, Ohio has had another boom in various liquids elements in the rich production from the Utica Shale deposit.

Ohio has witnessed a host of new natural gas processing and fractionating plants built, along with billions in investments by a booming chemicals and plastics area that uses natural gas and NGLs as feedstock. Economists say that the Utica Shale has brought in $86 billion in new capital investments and creating over 200,000 new jobs for Ohio citizens.

Of course, like most industries during the COVID-19 pandemic, the Utica Shale was greatly affected. The reduction of global crude demand that began a year ago resulted in a decline in new industry capital investment as companies raced to cut costs anywhere they could. Fortunately, with political leaders pushing the industry as a critical component for future economic growth, the Utica Shale is back on its feet.

Utica Shale Is Still Strong

Despite the considerable blow it took at the start of the pandemic in 2020, the Utica Shale shows promising resource production. While the global demand starts to recover, more rigs being built, and jobs lost during the pandemic being rescued, the industry is looking at a better year.

Did you enjoy this article? If so, remember to subscribe and follow our website so you can stay up to date on the latest shale and natural gas news!