Jack Chan Finds Data Supportive of Higher Oil Prices

Source: Jack Chan for The Energy Report 02/11/2017

Technical Analyst Jack Chan reads the charts and sees a major buy signal for energy.

$OSX is on a major buy signal, which can last for months and years.

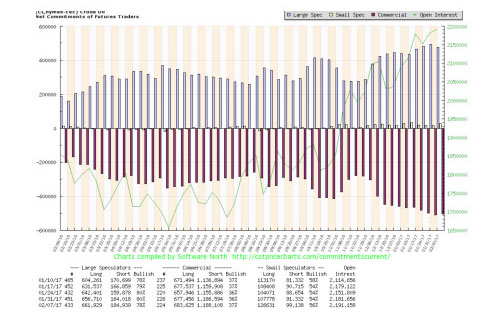

COT data is supportive for overall higher oil prices.

OIH is one of a few energy sector ETFs we are holding for long term gains.

Prices dipped into our buy zone in November, and again this week.

Our trading model identifies the buy zones in a bull market, simple and effective.

Energy sector gave a major buy signal in 2016, and the current correction has dropped prices into our buy zone.

Summary

Energy sector is on a major buy signal.

Prices are now in our buy zone.

We are holding energy sector ETFs for long term gains.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles with industry analysts and commentators, visit our Streetwise Articles page.

1) Statements and opinions expressed are the opinions of Jack Chan and not of Streetwise Reports or its officers. Jack Chan is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) Jack Chan: We do not offer predictions or forecasts for the markets. What you see here is our simple trading model, which provides us the signals and set-ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion. We also provide coverage to the major indexes and oil sector.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Charts courtesy of Jack Chan

Connect with us on Facebook and Twitter!

Follow @EnergyNewsBlog