Analyst: Stay Away From Chesapeake Energy, Turnaround is Not Coming

From Seeking Alpha:

Connect with us on Facebook and Twitter!

Follow @EnergyNewsBlog

For Chesapeake Energy (NYSE:CHK), 2016 is turning out to be no different from how it had performed on the stock market in the last couple of years. Ever since the decline in oil & gas prices began, Chesapeake shares have been tumbling, and it looks like 2016 will be the worst year of the lot, as CHK is already down over 31%. In my opinion, it will be good for investors to stay away from Chesapeake Energy, as a turnaround is not coming - and there are a few reasons why I think so.

In a precarious situation

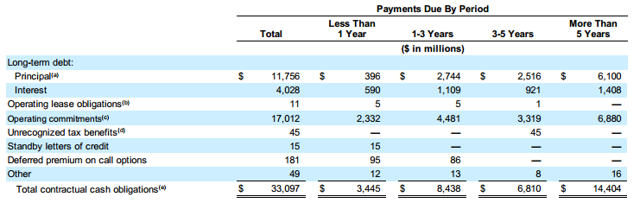

At present, the company has around $11.6 billion in debt, which is more than five times its market capitalization, while a current ratio of just 0.79 indicates that a liquidity crisis for Chesapeake Energy cannot be ruled out. This is especially because the company has to contend with a number of debt maturities that are expected to mature in the coming years, as shown below:

The rest of the article is available by clicking here.

(Source: 10-K)

The chart above illustrates Chesapeake's debt position at the end of 2014, as reported by the company in its last-released annual report. I'm taking this as a reference case, because the company's current debt of $11.6 billion is quite close to the debt position it had at the end of 2014. Now, Chesapeake's interest burden of around $3.5 billion (excluding the interest on the maturity of the debt in less than 1 year) is quite high, as the company has generated less than $14 billion in revenue in the past year.

Connect with us on Facebook and Twitter!

Follow @EnergyNewsBlog